InsuranceZoom․Online is your go-to guide for all insurance needs, offering comprehensive insights into various policies, tips, and strategies to make informed decisions seamlessly․

Perfect for beginners and experienced individuals alike, this platform simplifies complex insurance jargon, helping you navigate coverage options with confidence and clarity․

1․1 Overview of InsuranceZoom․Online

InsuranceZoom․Online serves as a comprehensive resource, offering detailed guides on various insurance types, including car, home, and travel coverage․ It provides expert tips, step-by-step processes, and strategies to help users make informed decisions․ The platform emphasizes simplifying complex insurance terms, ensuring clarity and confidence for all users․ Its goal is to empower individuals with knowledge, making insurance selection and management straightforward and efficient․

1․2 Importance of Insurance in Modern Life

Insurance plays a vital role in modern life by providing financial protection and peace of mind․ It safeguards against unexpected events like accidents, health issues, or property damage, ensuring stability in uncertain times․ By managing risks effectively, insurance helps individuals and families maintain their quality of life, making it an essential tool for securing the future and achieving long-term financial goals․

Types of Insurance Coverage

Explore various insurance types, including car, home, travel, health, and life insurance, each designed to protect different aspects of your life and assets effectively․

2․1 Car Insurance: Benefits and Features

Car insurance from Allianz offers comprehensive coverage, including collision, liability, and theft protection․ It provides financial security against accidents, damages, and third-party claims․ Additional features like roadside assistance, rental car coverage, and discounts for safe drivers enhance your policy․ With customizable options, Allianz ensures tailored protection for your vehicle, giving you peace of mind on and off the road․

2․2 Home and Travel Insurance Options

Home insurance protects your property from damage and liability, while travel insurance covers trip cancellations, medical emergencies, and lost luggage․ InsuranceZoom․Online offers tailored options to suit your lifestyle, ensuring comprehensive coverage for both home and travel needs․ With flexible policies and expert tips, you can secure your assets and enjoy peace of mind wherever life takes you․

How to Choose the Right Insurance Policy

Choosing the right insurance policy involves understanding your needs, comparing coverage options, and evaluating exclusions․ InsuranceZoom․Online provides expert tips to help you make informed decisions․

3․1 Assessing Your Insurance Needs

Assessing your insurance needs is crucial for securing the right coverage․ Evaluate your personal circumstances, financial goals, and potential risks․ Consider factors like lifestyle, assets, and dependents to determine the level of protection required․ Understanding your needs helps tailor policies to your unique situation, ensuring you’re adequately covered without unnecessary extras․ This step ensures your insurance aligns with your life’s demands and provides lasting financial security․

3․2 Tips for Comparing Policies Effectively

When comparing insurance policies, focus on coverage details, exclusions, and premiums․ Evaluate benefits, limits, and deductibles to ensure alignment with your needs․ Read reviews and ask questions to clarify terms․ Avoid unnecessary add-ons and prioritize transparent policies․ Understanding the claims process and customer support can also influence your decision, ensuring you select the best option for your lifestyle and budget effectively․

Understanding Insurance Coverage and Exclusions

Understanding coverage and exclusions is crucial to avoid financial surprises․ Review policy terms to identify what’s included and excluded, ensuring alignment with your needs and risks effectively․

4․1 Key Features of Insurance Policies

Insurance policies typically include coverage limits, deductibles, and add-ons․ These features define the scope of protection, out-of-pocket costs, and additional benefits․ Riders enhance coverage for specific needs, while exclusions outline what’s not covered․ Understanding these elements ensures clarity and alignment with your financial goals, helping you make informed decisions to protect your assets effectively and avoid unexpected gaps in coverage․

4․2 Common Exclusions to Be Aware Of

Insurance policies often exclude coverage for pre-existing conditions, certain types of damage, or specific events like natural disasters․ Understanding these exclusions is crucial to avoid denied claims․ Review your policy carefully to identify what’s not covered, as exclusions vary by provider and policy type․ This knowledge helps you make informed decisions and avoid unexpected gaps in protection when you need it most․

Maximizing Your Insurance Benefits

Maximize your insurance benefits by exploring riders, add-ons, and cost-saving strategies to enhance coverage while optimizing premium expenses for tailored protection and financial security․

5;1 Riders and Add-Ons for Enhanced Coverage

Riders and add-ons are optional enhancements to your insurance policy, offering tailored coverage for specific needs․ Riders provide additional benefits like critical illness or disability coverage, while add-ons expand policy features, such as comprehensive coverage for car insurance․ These enhancements allow policyholders to address gaps in their coverage and enjoy more comprehensive protection without purchasing entirely new policies․

5․2 Strategies to Save on Premiums

To save on premiums, compare policies to find the best rates, and understand what’s included or excluded․ Opt for higher deductibles to lower costs and take advantage of discounts like multi-policy or loyalty benefits․ Regularly assess your coverage needs and adjust policies to avoid over-insurance․ Bundling policies and maintaining a good credit score can also lead to significant savings over time․

The Claims Process: What You Need to Know

The claims process is designed to be straightforward and stress-free․ Provide detailed documentation, file claims promptly, and maintain clear communication with your insurer for a smooth experience․

6․1 Steps to File a Claim Successfully

To file a claim successfully, start by reviewing your policy to understand coverage and requirements․ Gather all necessary documents, such as proof of loss and police reports․ Notify your insurer promptly and provide detailed information about the incident․ Submit your claim through the designated platform or contact your agent directly․ Follow up regularly to ensure your claim is processed efficiently and address any additional requests from your insurer․

6․2 Tips for a Smooth Claims Experience

For a seamless claims experience, stay organized with all necessary documents and communicate clearly with your insurer․ Regularly follow up on your claim’s status and promptly address any requests for additional information․ Keeping detailed records of interactions and maintaining patience throughout the process can significantly enhance your overall experience and ensure a swift resolution․

The Role of Technology in Insurance

Technology transforms the insurance industry by enhancing efficiency, personalizing policies, and improving customer experiences․ Digital innovations like AI and automation streamline processes, ensuring better risk management and faster claim resolutions․

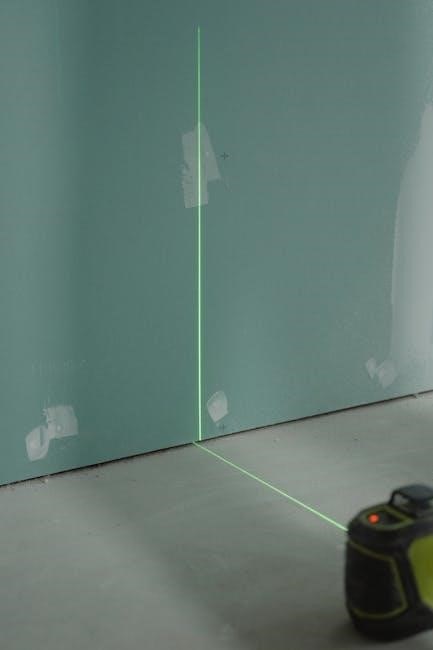

7․1 Digital Tools for Buying and Managing Policies

Digital tools revolutionize the insurance experience, offering e-applications, video conferencing, and online platforms for seamless policy management․ These tools enable customers to compare policies, purchase coverage, and access documents effortlessly․ Advanced software like MedicareCENTER streamlines processes, while platforms like InsuranceZoom․Online provide personalized dashboards for tracking and updating policies․ This technology enhances efficiency, transparency, and customer satisfaction, making insurance management more accessible than ever․

7․2 The Future of Insurance Automation

Insurance automation is transforming the industry, leveraging AI, machine learning, and data analytics to enhance efficiency and personalization․ Automated systems streamline claims processing, policy underwriting, and customer service, reducing costs and improving accuracy․ The future holds potential for hyper-personalized products and real-time risk assessments, ensuring a seamless and intuitive experience for customers․ Open insurance and ecosystem development will further unlock innovation and growth in the sector․

Building Trust: Reviews and Reputation

Building trust is crucial in the insurance industry, where credibility and reliability are paramount․ Positive reviews and a strong reputation help establish confidence in potential customers․

High-quality reviews and testimonials serve as social proof, showcasing a company’s commitment to excellence and customer satisfaction, which are essential for long-term success in the insurance market․

8․1 Importance of Online Reviews in Insurance

Online reviews play a vital role in building trust and credibility for insurance providers․ They serve as social proof, helping potential customers assess reliability and transparency․ Positive reviews highlight a company’s commitment to excellence and customer satisfaction, fostering confidence in their services․ For insurance seekers, these insights are invaluable, enabling informed decisions and reinforcing the provider’s reputation in a competitive market․

8․2 Building Credibility in the Insurance Industry

Building credibility in the insurance industry requires transparency, ethical practices, and consistent customer satisfaction; Providers must demonstrate expertise and reliability, fostering trust through clear communication and fair policies․ Companies like Allianz exemplify this by offering tailored solutions and maintaining high standards of service․ Credibility is further enhanced through financial stability and adaptability to evolving market needs, ensuring long-term customer confidence and loyalty․

Navigating Complex Insurance Terminology

InsuranceZoom․Online simplifies complex terms, offering clear definitions and resources to help users understand policies with ease, ensuring informed decisions without confusion․

9․1 Simplifying Insurance Jargon

InsuranceZoom․Online demystifies complex terms, making insurance accessible to everyone․ By breaking down jargon into clear, concise language, the platform ensures users understand key concepts like deductibles, coverage limits, and exclusions․ This approach empowers individuals to make informed decisions without getting lost in technical terms, fostering confidence in navigating their insurance needs effectively․

9․2 Resources for Further Learning

InsuranceZoom․Online offers a wealth of resources to deepen your insurance knowledge, including detailed guides, informative articles, and expert tips․ From video tutorials to downloadable tools, these resources cater to both beginners and advanced learners․ Explore topics like policy comparisons, claims processes, and coverage enhancements to gain a comprehensive understanding of insurance and make well-informed decisions for your future․

InsuranceZoom․Online empowers you to make informed decisions with confidence․ Stay ahead by choosing the right coverage and keeping up with the latest insurance trends․

10․1 Final Tips for Choosing the Best Coverage

Assess your needs and budget to select policies that align with your lifestyle․ Compare coverage options and exclusions thoroughly․ Consider add-ons for enhanced protection․ Read reviews and seek professional advice to ensure you make informed decisions․ Stay updated on insurance trends to optimize your coverage and benefits over time․

10․2 Staying Informed About Insurance Trends

Stay updated on industry changes and emerging technologies shaping insurance․ Explore digital tools and automation trends that enhance policy management․ Follow expert insights and resources like InsuranceZoom․Online for the latest updates․ Adapt to evolving coverage options and customer needs to ensure your insurance strategy remains effective and aligned with current market demands and innovations․